Sprott Gold Miners ETF (SGDM)

60.77

+1.25 (2.10%)

NYSE · Last Trade: Sep 28th, 12:24 AM EDT

While 2025 thus far has been all about headlines regarding AI stocks and semiconductor ETFs, one of the year’s most sensational performers comes from a category few would anticipate: gold miners.

Via Benzinga · September 25, 2025

Gold prices surge as Fed rate cuts, dollar weakness, and central bank buying fuel demand. Discover top gold miners ETFs to ride the momentum.

Via Benzinga · September 24, 2025

Gold is soaring to its second-best year in half a century, up over 43% as investors hedge against inflation and geopolitical risks.

Via Benzinga · September 23, 2025

Discover why UBS and Deutsche Bank have raised their gold price forecasts, with targets up to $4,000 per ounce by 2026.

Via Benzinga · September 18, 2025

The precious metals complex may be ending a 2-month pullback/consolidation pattern.

Via Talk Markets · July 13, 2023

Precious metals are up significantly this year, with gold and silver rising 39.16% and 42.17%. Junior mining firms have potential for big gains.

Via Benzinga · September 11, 2025

Gold prices are rising, strengthening miners' finances. Cash reserves may trigger mergers & acquisitions or dividends.

Via Benzinga · August 4, 2025

Barrick Gold reports solid Q1 results with revenue of $3.13B, in line with consensus. Gold production and sales fell, but realized prices rose. Copper production surged and dividend declared.

Via Benzinga · May 7, 2025

Investors are flocking to gold-backed ETFs as global tensions and uncertainty drive up gold prices. Gold miners also see record demand.

Via Benzinga · April 11, 2025

Barrick Gold Corp reported Q4 revenue of $3.645B, missing consensus. Adjusted EPS beat consensus. Cash and cash equivalents at $4.07B, debt at $4.73B. Dividend declared, share repurchase program approved.

Via Benzinga · February 12, 2025

2024 was a big year for gold and 2025 could be even bigger for the stocks of companies that mine it.

Via Talk Markets · December 31, 2024

Barrick Gold Corp (NYSE: GOLD) reported lower revenue and missed consensus, with lower gold and copper production. Dividend and repurchase announced.

Via Benzinga · November 7, 2024

Barrick Gold reports preliminary Q3 production results with 943,000 oz gold and 48,000 tonnes copper, aiming for full-year guidance.

Via Benzinga · October 16, 2024

Barrick Gold Corp reports strong Q2 results, with revenue up 12% and EPS exceeding consensus. The company is focused on increasing production and expanding assets, with a dividend declared and shares being bought back.

Via Benzinga · August 12, 2024

Barrick Gold shares rise on trader optimism for rate cut & strong preliminary Q2 production. Expected to meet 2024 targets with higher output.

Via Benzinga · July 16, 2024

Barrick Gold reported first-quarter revenue of $2.747 billion (+4% Y/Y), which is in line with the consensus. Gold production stood at 940 thousand ounces (-1% Y/Y), and gold sales were 910 thousand ounces (-5% Y/Y).

Via Benzinga · May 1, 2024

Gold prices expected to rise to $2,500-$2,600 per ounce, making it a valuable hedge for equity investors. Central bank purchases driving demand.

Via Benzinga · March 21, 2024

Gold prices surge on record close and mining stock rally. GLD reaches $2,110/oz, within 1.4% of all-time high.

Via Benzinga · March 4, 2024

Gold stocks at 50-80% discount present a unique opportunity. Newmont is undervalued despite 10% rise in gold prices.

Via Benzinga · February 15, 2024

Metal miners are the biggest beneficiaries of the surge in gold price as the mining companies act as a leveraged play on the underlying metal prices and thus tend to experience more gains than their bullion cousins in a rising metal market.

Via Talk Markets · October 16, 2023

Spot gold prices declined by about 1.25% on Thursday, triggered by the release of advance estimates data by the U.S. Bureau of Economic Analysis.

Via Benzinga · July 27, 2023

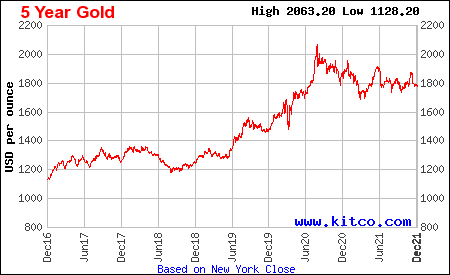

Through the past year gold has struggled somewhat as it continues to digest the strong gains of the last two years. Many wonder, has gold lost its golden touch? But remember, gold was $1,200 as recently as late 2018. It’s now almost 50% higher.

Via Talk Markets · December 26, 2021