McKesson Corp (MCK)

987.37

+12.92 (1.33%)

NYSE · Last Trade: Feb 27th, 4:32 PM EST

Detailed Quote

| Previous Close | 974.45 |

|---|---|

| Open | 977.28 |

| Bid | 986.00 |

| Ask | 989.00 |

| Day's Range | 974.00 - 987.37 |

| 52 Week Range | 619.48 - 977.27 |

| Volume | 998,488 |

| Market Cap | 152.72B |

| PE Ratio (TTM) | 28.47 |

| EPS (TTM) | 34.7 |

| Dividend & Yield | 3.280 (0.33%) |

| 1 Month Average Volume | 854,276 |

Chart

About McKesson Corp (MCK)

McKesson Corporation is a leading healthcare services and information technology company that specializes in the distribution of pharmaceuticals and medical supplies. The company provides a comprehensive range of services that enhance the efficiency of healthcare systems, including drug distribution to pharmacies, hospitals, and other healthcare providers. Additionally, McKesson offers innovative solutions for managing medical costs, optimizing inventory, and improving patient care through data analytics and technology. By ensuring the timely delivery of critical medical products and services, McKesson plays a vital role in the healthcare ecosystem, supporting both providers and patients. Read More

News & Press Releases

The latest data from the U.S. Census Bureau, released in late February 2026, suggests a surprising degree of resilience within the American supply chain. Wholesale inventories for December 2025 rose by a modest 0.2%, reaching a total of $918.0 billion. This figure, which aligns perfectly with analyst

Via MarketMinute · February 27, 2026

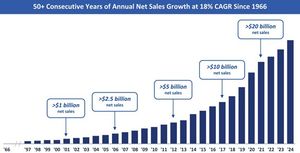

The best-performing stocks typically have robust sales growth, increasing margins, and rising returns on capital,

and those that can maintain this trifecta year in and year out often become the legends of the investing world.

Via StockStory · February 19, 2026

Exciting developments are taking place for the stocks in this article.

They’ve all surged ahead of the broader market over the last month as catalysts such as new products and positive media coverage have propelled their returns.

Via StockStory · February 16, 2026

McKesson Corp (NYSE:MCK) Reports Mixed Q3 2026 Results and Raises Full-Year Profit Outlookchartmill.com

Via Chartmill · February 4, 2026

McKesson Corp (NYSE:MCK) Fits the 'Affordable Growth' Investment Profilechartmill.com

Via Chartmill · January 29, 2026

McKesson Corp (NYSE:MCK) Demonstrates Strong Growth and Technical Breakout Potentialchartmill.com

Via Chartmill · January 20, 2026

Each stock in this article is trading near its 52-week high.

These elevated prices usually indicate some degree of investor confidence, business improvements, or favorable market conditions.

Via StockStory · February 15, 2026

McKesson’s fourth-quarter results met Wall Street’s revenue expectations and modestly exceeded consensus for non-GAAP earnings per share, with the market responding positively. Management attributed the growth to robust performance in oncology, expanded biopharma services, and continued momentum in North American pharmaceutical distribution. CEO Brian Tyler specifically highlighted the integration of recent acquisitions such as Florida Cancer Specialists and Prism Vision as meaningful contributors. The company also cited the impact of technology investments, which improved workflow efficiency and productivity across segments.

Via StockStory · February 11, 2026

McKesson Corporation (NYSE: MCK) stands today as the undisputed titan of the U.S. pharmaceutical supply chain. While the company has long been a staple of the Fortune 500, its relevance has surged in early 2026 as it navigates a complex landscape of drug shortages, revolutionary new therapies, and a massive internal restructuring. The company is [...]

Via Finterra · February 6, 2026

Thursday's session: top gainers and losers in the S&P500 indexchartmill.com

Via Chartmill · February 5, 2026

Medline is an appealing investment candidate – it has solid growth, operates in a steady industry, and a storied history.

Via The Motley Fool · February 5, 2026

Healthcare distributor and services company McKesson (NYSE:MCK) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.4% year on year to $106.2 billion. Its non-GAAP profit of $9.34 per share was 0.7% above analysts’ consensus estimates.

Via StockStory · February 5, 2026

McKesson (MCK) Q3 2026 Earnings Call Transcript

Via The Motley Fool · February 4, 2026

Healthcare distributor and services company McKesson (NYSE:MCK) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.4% year on year to $106.2 billion. Its non-GAAP profit of $9.34 per share was 0.7% above analysts’ consensus estimates.

Via StockStory · February 4, 2026

McKesson Corporation (NYSE: MCK) has released its fiscal 2026 third quarter financial results. Results can be accessed on McKesson’s Investor Relations website at investor.mckesson.com/financials/quarterly-results.

By McKesson Corporation · Via Business Wire · February 4, 2026

Healthcare distributor and services company McKesson (NYSE:MCK)

will be announcing earnings results this Wednesday after the bell. Here’s what to expect.

Via StockStory · February 2, 2026

McKesson Corporation (NYSE: MCK) announced today that it has closed the transaction to sell its retail and distribution businesses in Norway to NorgesGruppen, a privately owned retail group.

By McKesson Corporation · Via Business Wire · January 30, 2026

The Board of Directors of McKesson Corporation (NYSE: MCK) yesterday declared a regular dividend of 82 cents per share of common stock. The dividend will be payable on April 1, 2026, to shareholders of record on March 2, 2026.

By McKesson Corporation · Via Business Wire · January 28, 2026

An improving earnings profile, aggressive buybacks, and a renewed focus on margins might be changing how long-term investors think about this healthcare distributor.

Via The Motley Fool · December 29, 2025

The global healthcare landscape shifted decisively on December 16, 2025, with the public market return of Medline Industries (Nasdaq: MDLN). After four years under the stewardship of a private equity consortium—and decades of private family ownership before that—the medical supply titan has reclaimed its status as a public entity in the largest U.S. initial public [...]

Via PredictStreet · December 18, 2025

McKesson Corp exemplifies GARP investing, offering strong earnings growth at a reasonable valuation within the vital healthcare supply chain.

Via Chartmill · December 26, 2025

Large-cap stocks are known for their staying power and ability to weather market storms better than smaller competitors.

However, their sheer size makes it more challenging to maintain high growth rates as they’ve already captured significant portions of their markets.

Via StockStory · December 23, 2025

McKesson trades at $825.38 and has moved in lockstep with the market. Its shares have returned 14.5% over the last six months while the S&P 500 has gained 12.9%.

Via StockStory · December 23, 2025

CRANFORD, NJ — As the 2025 calendar year draws to a close, Citius Oncology, Inc. (Nasdaq: CTOR) has reached a pivotal juncture in its corporate evolution. Following the release of its SEC 10-K filing for the fiscal year ended September 30, 2025, the company has officially shed its "development-stage" label, entering

Via MarketMinute · December 23, 2025

McKesson Corporation (NYSE: MCK) will release its third quarter fiscal 2026 financial results after market close on Wednesday, February 4, 2026. The company will host a live webcast of the earnings conference call for investors at 4:30 PM Eastern Time to review its financial results.

By McKesson Corporation · Via Business Wire · December 22, 2025