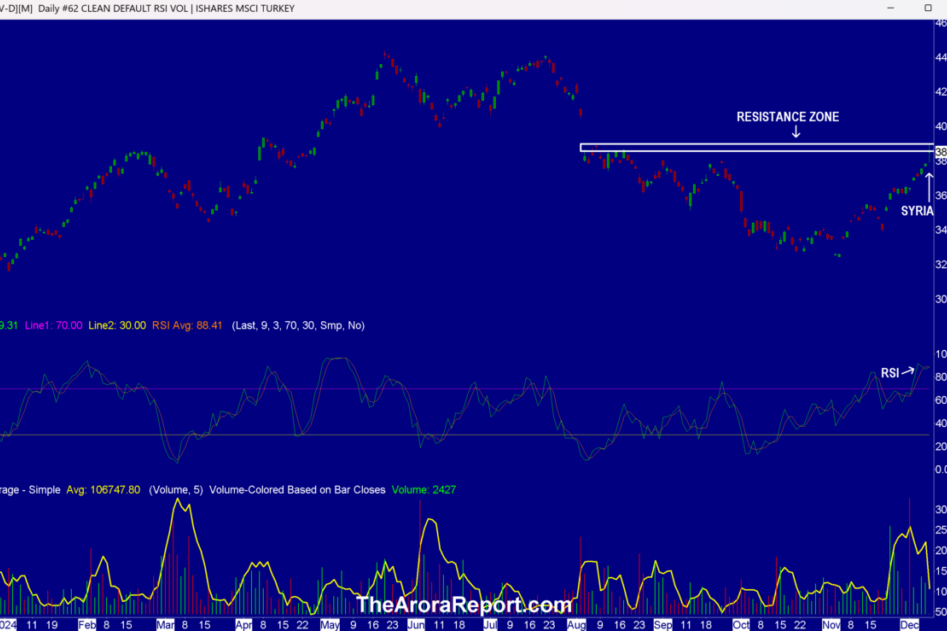

iShares MSCI Turkey ETF (TUR)

41.21

+0.24 (0.59%)

NASDAQ · Last Trade: Feb 11th, 12:44 PM EST

Detailed Quote

| Previous Close | 40.97 |

|---|---|

| Open | 41.31 |

| Day's Range | 41.07 - 41.34 |

| 52 Week Range | 29.64 - 41.82 |

| Volume | 178,311 |

| Market Cap | - |

| Dividend & Yield | 0.7180 (1.74%) |

| 1 Month Average Volume | 379,079 |

Chart

News & Press Releases

We're truly dealing with equity market destruction of epic proportions since the President re-took office.

Via Talk Markets · April 21, 2025

At the April Monetary Policy Committee meeting, the Central Bank of Turkey (CBT) hiked its policy rate by 350bp to 46% and preserved its flexibility by maintaining the asymmetry in the rate corridor.

Via Talk Markets · April 18, 2025

To gain an edge, this is what you need to know today.

Via Benzinga · December 9, 2024

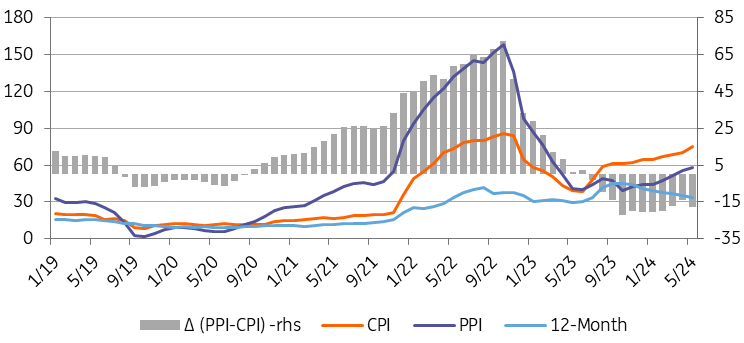

The food group was once again the key driver behind Turkey’s rising inflation rate in November following a similar trend in October. Even so, the downtrend in the annual inflation rate has remained in place.

Via Talk Markets · December 3, 2024

The Lira now holds 19% of the market share, surpassing the euro.

Via Talk Markets · June 13, 2024

The improvement in the current account deficit in March was attributable to the continuing recovery in the foreign trade deficit.

Via Talk Markets · May 13, 2024

Turkey’s economic activity has lost further momentum in the third quarter thanks to tight financial conditions, while its growth composition improved further on the back of a higher contribution from net exports.

Via Talk Markets · November 29, 2024

The central bank seems to have slowed down the depreciation of the lira recently. It has done this not by selling FX to the market, but by slowing down the pace of FX purchases.

Via Talk Markets · November 8, 2024

Turkey’s current account recorded a large surplus in August, while the 12-month rolling deficit plunged to its lowest since the end of 2021. We think the external outlook will likely remain benign in the near term.

Via Talk Markets · October 11, 2024

As widely expected, Turkey’s central bank has kept rates on hold (50%) at the September rate-setting meeting, reiterating its attentiveness to inflation risks.

Via Talk Markets · September 19, 2024

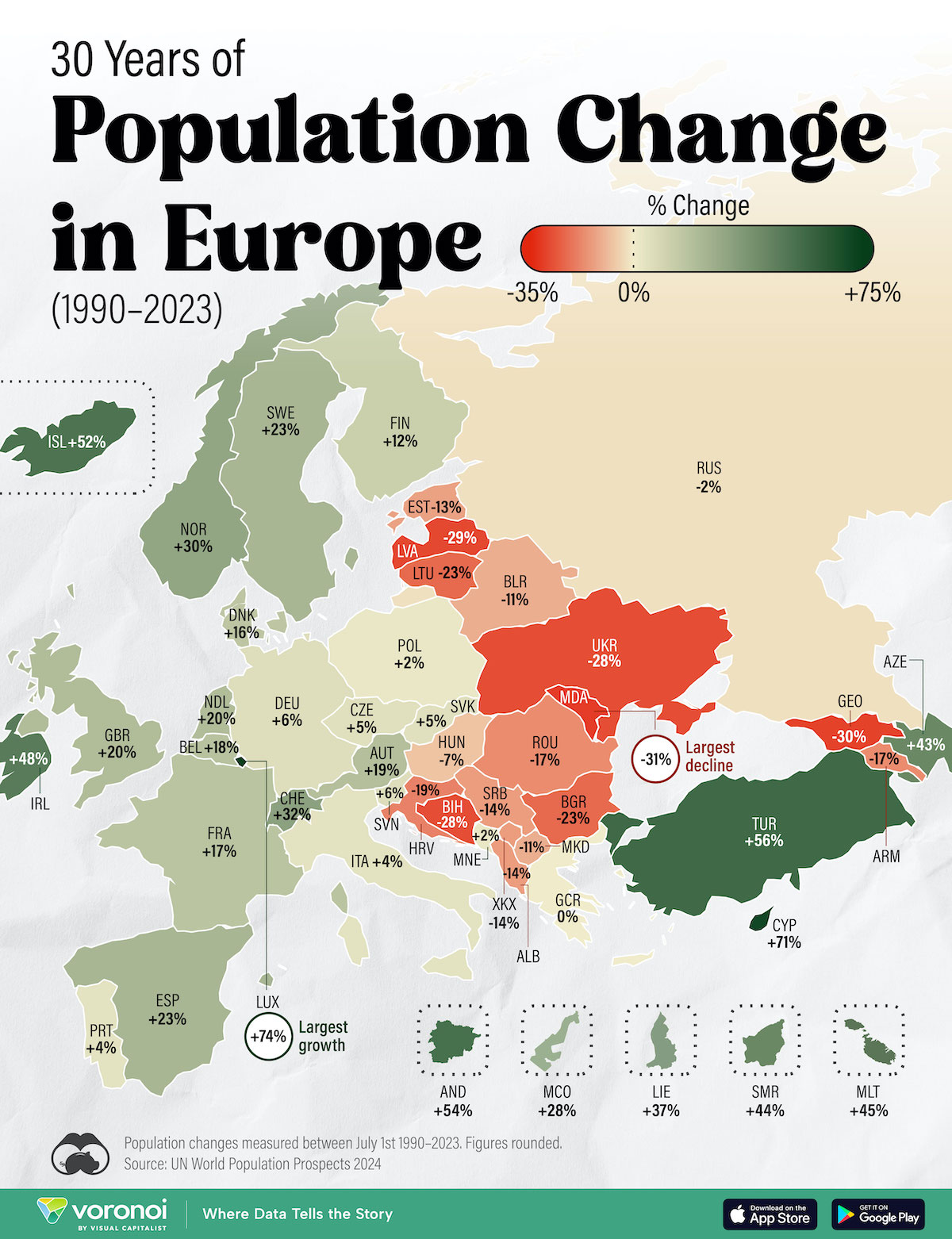

Between 1990 and 2023, the world population grew by more than 50%. But not all countries grew at the same rate, and some in fact, some didn’t grow at all.

Via Talk Markets · August 7, 2024

Global markets faced turbulence on Wednesday, with Turkish assets experiencing significant declines amid a backdrop of international economic concerns.

Via Talk Markets · July 24, 2024

While the policy rate was kept on hold at 50% in its June MPC meeting, the Central Bank of Turkey retained its tightening bias and continued to monitor liquidity conditions.

Via Talk Markets · June 27, 2024

Because of a temporary increase in the April trade deficit, the improvement in the current account was interrupted, although provisional data for May hints at a return to the recovery trend.

Via Talk Markets · June 10, 2024

Turkey’s annual inflation reached its cyclical peak in May at 75.4% with price increases across the board in both food and non-food groups, in addition to one-off effects from the energy group.

Via Talk Markets · June 3, 2024

In this week’s Dirty Dozen we cover crashing fund flows, an aging Risk Cycle, mild intermediate sentiment, stretched gold, a confirmed breakout in a potash producer, and a major squeeze in currencies, plus more…

Via Talk Markets · May 28, 2024

US GDP for the first quarter and the Federal Reserve’s favored measure of inflation, the core PCE deflator, will be the main releases to watch next week.

Via Talk Markets · April 19, 2024

The downward trend in the Turkish current account remained intact in February, with a further drop in the 12-month rolling deficit to US$31.8bn from US$37.5bn a month ago.

Via Talk Markets · April 17, 2024

Turkey's stock market fell, bond yields rose after opposition party won 5 biggest cities in local elections, biggest setback for Erdogan's party.

Via Benzinga · April 1, 2024

The Central Bank of Turkey hiked its policy rate by 500bp to 50% and announced a large set of macro-prudential measures and significant efforts to mop up excess TRY liquidity.

Via Talk Markets · March 21, 2024

Turkey's fourth-quarter GDP data showed that private spending has accelerated despite an increasingly restrictive policy stance while leading indicators point to a further acceleration in GDP growth in the first quarter of this year.

Via Talk Markets · March 8, 2024

Earlier, the GBP/USD pair rose to 1.2722 on Tuesday after data from the economic calendar showed that the US ISM services PMI reading came in at 52.6 in February

Via Talk Markets · March 7, 2024

There are plenty of emerging markets opportunities, but the three “Ts” are some of the best available at the current time.

Via InvestorPlace · February 28, 2024

The focus of next week will be Poland's fourth quarter GDP flash estimate for 2023, which we expect to come in at 1.0% YoY.

Via Talk Markets · February 23, 2024