Trimble Inc. - Common Stock (TRMB)

66.15

+2.17 (3.39%)

NASDAQ · Last Trade: Feb 8th, 1:07 PM EST

Detailed Quote

| Previous Close | 63.98 |

|---|---|

| Open | 65.11 |

| Bid | 64.56 |

| Ask | 67.00 |

| Day's Range | 64.58 - 66.33 |

| 52 Week Range | 52.91 - 87.50 |

| Volume | 1,991,100 |

| Market Cap | 15.74B |

| PE Ratio (TTM) | 90.62 |

| EPS (TTM) | 0.7 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 2,227,752 |

Chart

About Trimble Inc. - Common Stock (TRMB)

Trimble Navigation is a technology company that specializes in providing advanced positioning, modeling, and data analytics solutions. Their products and services integrate a variety of technologies, including GPS, laser scanning, and software applications, to enhance productivity and efficiency in diverse sectors such as agriculture, construction, geospatial, and transportation. Trimble's innovative tools enable customers to collect and analyze critical data, optimize workflows, and improve decision-making, supporting various industries in achieving precision and accuracy in their operations. Read More

News & Press Releases

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

Billionaires are buying this maker of critical mapping and positioning software at a discount.

Via The Motley Fool · February 1, 2026

Shares of geospatial technology provider Trimble (NASDAQ:TRMB) fell 5.7% in the afternoon session after the company's President and CEO, Robert G Painter, sold a significant block of shares.

Via StockStory · January 16, 2026

Exploring the top movers within the S&P500 index during today's session.chartmill.com

Via Chartmill · January 16, 2026

These S&P500 stocks are moving in today's sessionchartmill.com

Via Chartmill · January 16, 2026

Wall Street is overwhelmingly bullish on the stocks in this article, with price targets suggesting significant upside potential.

However, it’s worth remembering that analysts rarely issue sell ratings, partly because their firms often seek other business from the same companies they cover.

Via StockStory · January 14, 2026

This industrial software stock warrants a valuation rerating, which could lead to significant share price appreciation in the coming years.

Via The Motley Fool · January 3, 2026

Trimble has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 9.9% to $81.01 per share while the index has gained 12.9%.

Via StockStory · December 23, 2025

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the internet of things stocks, including Trimble (NASDAQ:TRMB) and its peers.

Via StockStory · December 23, 2025

Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages.

Just because a business is in the green today doesn’t mean it will thrive tomorrow.

Via StockStory · December 21, 2025

San Francisco, CA – December 12, 2025 – Sitewire, a leading construction finance platform, has just announced the launch of two groundbreaking AI-powered tools, BudgetIQ™ and PermitIQ™. Unveiled on December 10, 2025, these innovative solutions are set to fundamentally transform the pre-construction phase for residential builders by automating critical financial and regulatory risk reviews. The [...]

Via TokenRing AI · December 12, 2025

The world is currently grappling with a potent and dangerous cocktail of climate change impacts and water scarcity, giving rise to a phenomenon dubbed "climateflation." This escalating crisis is driving up global food commodity prices and, critically, pushing millions in Africa to the brink of severe food insecurity, threatening financial

Via MarketMinute · December 12, 2025

Pre-market stock analysis of S&P500 stocks on 2025-12-05: top gainers and losers in today's session.

Via Chartmill · December 5, 2025

Whether you see them or not, industrials businesses play a crucial part in our daily activities. Their momentum is also rising as lower interest rates have incentivized higher capital spending.

As a result, the industry has posted a 19.6% gain over the past six months, beating the S&P 500 by 4.3 percentage points.

Via StockStory · December 4, 2025

ArrowMark’s sharp reduction in its Alight stake comes at a moment when the market is questioning whether the company can turn its consulting-heavy work into steadier recurring revenue, and that tension may say more about sentiment than about the strength of the platform itself.

Via The Motley Fool · December 4, 2025

The global wheat market in late 2025 presents a formidable landscape for farmers, characterized by a challenging confluence of persistent price volatility, stubbornly high input costs, and a complex web of geopolitical influences. While some forecasts suggest a potential increase in global wheat stocks for the 2025/26 marketing year,

Via MarketMinute · November 24, 2025

The underlying growth at this tech-focused company is exceptional.

Via The Motley Fool · November 24, 2025

The next phase of investing in AI is to look for companies that are successfully using AI to enhance the value of their offerings to customers.

Via The Motley Fool · November 24, 2025

November 14, 2025 – As the crisp air of winter settles across global markets, a less welcome chill is being felt in the produce aisles: exceptionally high prices for winter vegetables. Despite their seasonal arrival, staples like cauliflower, cabbage, and various gourds are fetching premium rates, signaling a deeper, more structural

Via MarketMinute · November 14, 2025

A number of stocks fell in the afternoon session after the broader U.S. stock market declined amid investor caution and a pullback in technology stocks.

Via StockStory · November 13, 2025

A number of stocks jumped in the afternoon session after investors continued to pile into value-oriented names amid growing valuation concerns.

Via StockStory · November 12, 2025

While strong cash flow is a key indicator of stability, it doesn’t always translate to superior returns.

Some cash-heavy businesses struggle with inefficient spending, slowing demand, or weak competitive positioning.

Via StockStory · November 6, 2025

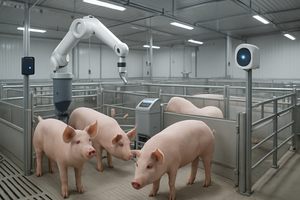

The global agricultural landscape is undergoing a profound transformation, with specialized niche markets emerging as significant drivers of innovation and investment. Among these, the precision swine farming market stands out, demonstrating remarkable growth and signaling a pivotal shift towards data-driven, sustainable, and highly efficient livestock production. Valued at approximately USD

Via MarketMinute · November 5, 2025

The US market is yet to commence its session on Wednesday, but let's get a preview of the pre-market session and explore the top S&P500 gainers and losers driving the early market movements.

Via Chartmill · November 5, 2025

Geospatial technology provider Trimble (NASDAQ:TRMB) announced better-than-expected revenue in Q3 CY2025, with sales up 2.9% year on year to $901.2 million. Guidance for next quarter’s revenue was better than expected at $947 million at the midpoint, 1.4% above analysts’ estimates. Its non-GAAP profit of $0.81 per share was 13% above analysts’ consensus estimates.

Via StockStory · November 5, 2025