Chesapeake Energy (CHK)

81.46

+0.00 (0.00%)

NASDAQ · Last Trade: Feb 17th, 9:19 PM EST

As the winter of 2026 reaches its midpoint, the global natural gas market has fractured into two starkly different realities. In the United States, Henry Hub futures have witnessed a dramatic 12.1% surge over the last two weeks, driven by a combination of unyielding Arctic weather and critical infrastructure

Via MarketMinute · January 20, 2026

The energy sector started the first week of 2026 with a stark and widening divergence between its two primary commodities. As of January 6, 2026, crude oil prices have surged to multi-month highs, driven by a dramatic escalation of geopolitical instability in South America and persistent tensions in the Middle

Via MarketMinute · January 6, 2026

As the 2025 holiday season reaches its peak, the global energy landscape is defined by a stark and unusual divergence. While crude oil prices have found a tenuous floor, remaining steady despite a backdrop of structural oversupply, natural gas prices are experiencing a sharp retreat. This "Great Energy Decoupling" reflects

Via MarketMinute · December 24, 2025

The global oil market is currently experiencing a significant downturn, characterized by a persistent oversupply that is forcing sellers to continuously offload crude. This trend, driven by a surge in non-OPEC+ production, a strategic shift in OPEC+ policy, and moderating global demand, has led to a dramatic plunge in crude

Via MarketMinute · December 17, 2025

The global energy market is navigating a significant shift as December 2025 concludes, with both crude oil and natural gas prices experiencing a notable downturn. This retreat marks a stark contrast to the robust performance observed earlier in the year, challenging the momentum of energy stocks and prompting a cautious

Via MarketMinute · December 17, 2025

The global natural gas market is poised for a transformative year in 2026, as the intricate interplay of escalating domestic power demand and a dramatic expansion of Liquefied Natural Gas (LNG) export capacity threatens to reshape price dynamics and supply stability. With the U.S. at the epicenter of this

Via MarketMinute · December 17, 2025

The global energy sector finds itself in turbulent waters as oil and gas company stocks experience a significant downturn, directly correlating with a persistent drop in commodity prices. As of December 16, 2025, a confluence of oversupply, weakening global demand, and broader macroeconomic headwinds has sent shockwaves through the market,

Via MarketMinute · December 16, 2025

As the global economy progresses through late 2025, a complex and often contradictory landscape of commodity prices is reshaping the outlook for manufacturing and employment worldwide. While overall commodity prices are projected to moderate, heading towards a six-year low in 2026, driven by subdued global economic activity and an expanding

Via MarketMinute · December 11, 2025

In a significant pronouncement for the energy sector, Williams (NYSE: WMB) President and CEO Chad Zamarin has articulated a long-term vision for natural gas prices, suggesting they will remain within a moderate range. This outlook, shared in late 2025, comes amidst a complex market landscape characterized by immediate oversupply challenges

Via MarketMinute · December 3, 2025

New York, NY – December 3, 2025 – The natural gas market is currently experiencing a dramatic ascent, with U.S. futures prices testing new highs not seen in nearly three years. This significant rally is primarily fueled by increasingly colder weather forecasts across key consuming regions and a robust surge in

Via MarketMinute · December 3, 2025

The United States oil and gas industry is undergoing a profound transformation, marked by an aggressive wave of consolidation that is reshaping its competitive landscape and setting the stage for a new era of fewer, yet more formidable, players as the calendar turns to 2026. This strategic realignment, driven by

Via MarketMinute · December 2, 2025

Gulfport Energy (NYSE: GPOR) has significantly amplified its commitment to shareholder returns, announcing a substantial expansion of its share repurchase program for both 2025 and 2026. The move, which sees the company's total authorization balloon to $1.5 billion through the end of 2026, signals a robust financial position and

Via MarketMinute · November 21, 2025

The dynamic world of NYMEX natural gas has long been a hotbed of technical and fundamental interplay, where price movements can be as swift and unpredictable as the weather itself. While a specific "hammer reversal" candlestick pattern, once signaling a potential surge towards the $4.88 per MMBtu mark, emerged

Via MarketMinute · November 20, 2025

November 19, 2025 - The global commodity futures market is currently navigating a period of intense volatility and strategic recalibration. While overall commodity price indices are projected to see a modest contraction through 2026, marking a fourth consecutive year of moderation, this aggregate trend masks a deeply bifurcated market. Investors

Via MarketMinute · November 19, 2025

The United States natural gas market is entering the 2025-2026 winter heating season with a robust supply picture, characterized by significantly above-average storage levels and record domestic production. Despite forecasts for overall record demand, primarily driven by surging liquefied natural gas (LNG) exports, a milder near-term weather outlook is exerting

Via MarketMinute · November 19, 2025

New York, NY (November 18, 2025) – The benchmark NYMEX "front month" futures price for natural gas experienced a sharp single-day dive on Monday, November 17, falling by 20.5 cents, or a significant 4.5%. This abrupt decline saw the December futures contract settle at $4.361 per million British

Via MarketMinute · November 18, 2025

As of November 2025, global financial markets find themselves in a persistent state of heightened volatility, a multi-year trend driven by a complex interplay of geopolitical tensions, evolving monetary policy expectations, and ongoing concerns about asset valuations. This turbulent environment has led to significant and often unpredictable fluctuations across commodity

Via MarketMinute · November 12, 2025

The natural gas market has experienced a dramatic resurgence in late 2025, with prices surging to levels not seen in months, driven by robust demand, strong liquefied natural gas (LNG) exports, and looming winter weather concerns. This sharp upward movement, however, has also flashed warning signs of overextension, prompting analysts

Via MarketMinute · November 10, 2025

As the calendar turns towards the 2025/2026 winter withdrawal season, the U.S. natural gas market is poised for a potentially volatile period, with analysts eyeing a significant price rally. Driven by an anticipated surge in heating demand, robust liquefied natural gas (LNG) exports, and specific weather forecasts, natural

Via MarketMinute · November 7, 2025

Oklahoma City, OK – November 6, 2025 – SandRidge Energy (NYSE: SD) sent a clear message of operational strength and financial discipline to the market this week, reporting a robust third-quarter 2025 earnings per share (EPS) that significantly outstripped analyst expectations. The independent oil and natural gas producer announced an adjusted EPS

Via MarketMinute · November 6, 2025

The global energy market is currently exhibiting a fascinating divergence as natural gas prices climb steadily, fueled by anticipated colder weather and unprecedented liquefied natural gas (LNG) export demand. This upward trajectory for natural gas stands in stark contrast to the more subdued performance of crude oil prices and the

Via MarketMinute · November 3, 2025

The global natural gas market is currently experiencing a period of heightened volatility, with prices exhibiting a notable rebound in late October 2025. This resurgence is primarily driven by a sudden shift to colder weather forecasts across the central and eastern United States, alongside consistently robust liquefied natural gas (LNG)

Via MarketMinute · October 24, 2025

While initial observations might suggest a significant downturn for Antero Resources (NYSE: AR) shares on October 23, 2025, market data presents a more nuanced picture. The natural gas producer's stock experienced mixed movements today, with some reports indicating a slight positive gain, contrasting with a period of recent underperformance and

Via MarketMinute · October 23, 2025

Houston, TX – October 16, 2025 – The U.S. natural gas market is currently navigating a period of relative stability, as evidenced by recent reports from the U.S. Energy Information Administration (EIA). On Thursday, October 16, 2025, the EIA reported a net increase of 80 billion cubic feet (Bcf) in

Via MarketMinute · October 16, 2025

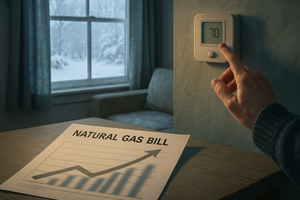

As the chill of the 2025-2026 winter season approaches, natural gas residential customers across the United States are bracing for a significant increase in their heating bills. This anticipated surge, projected to impact household budgets nationwide, stems from a complex interplay of burgeoning global demand for U.S. liquefied natural

Via MarketMinute · October 16, 2025